If a clinician is independently contracted for an organization through Axxess CARE and earns more than $600 within a calendar year, the organization is required to provide appropriate tax documentation to the clinician.

In most cases, clinicians must fill out and provide the organization with a W-9 document.

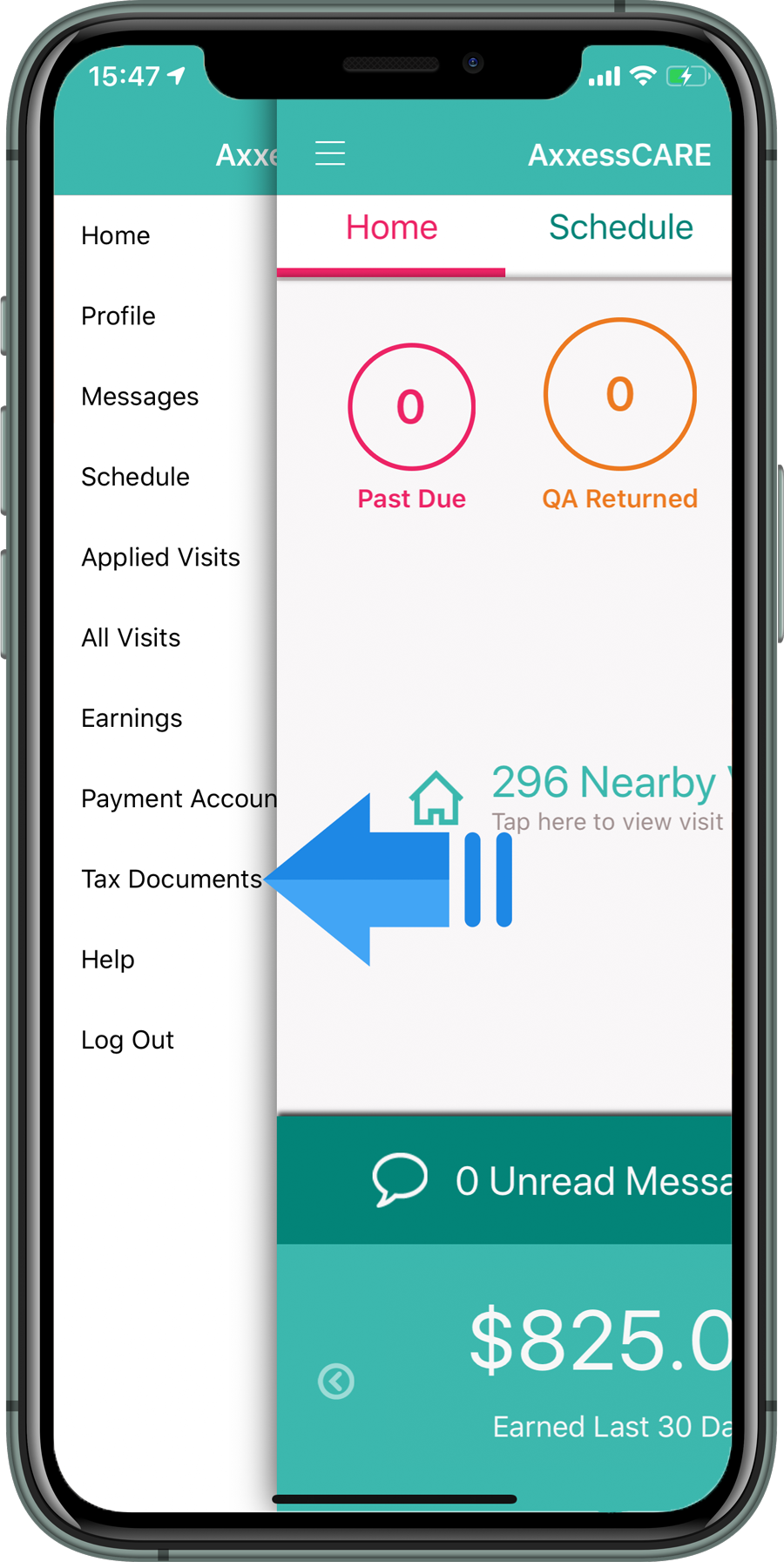

Once the appropriate tax document is complete, upload it as a PDF or take a picture of the document using the camera icon in Axxess CARE. There is also an option to complete the W-9 through the Axxess CARE app. Organizations who contract you through Axxess CARE can then access your completed forms to review and generate the appropriate tax documentation (e.g., 1099). Tax documents can be viewed and updated anytime in Axxess CARE.

Upload Clinician Tax Documents

To upload a clinician tax document to Axxess CARE:

It is your sole responsibility to comply with all federal, state and local tax obligations that pertain to all gross compensation you receive from organizations. We encourage you to speak with an appropriate professional for assistance in reporting your income to ensure compliance with any and all applicable federal, state and local laws or ordinances.