If your organization uses an independently contracted clinician through Axxess CARE and the clinician earns more than $600 within a calendar year, your organization is responsible for providing appropriate tax documentation.

Upload Agency Tax Documents

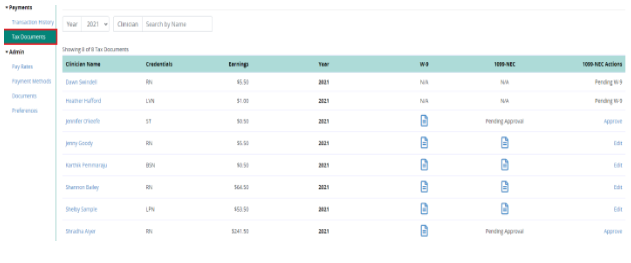

To upload or approve an organization tax document, navigate to the Tax Documents section of Axxess CARE and select Approve.

Payments section ➜ Tax Documents ➜ Upload Document

OR

Payments sections ➜ Tax Documents ➜ Upload File

You can edit approved 1099-NEC forms if there is a discrepancy. Approve and Generate a 1099-NEC form.

When approving the 1099-NEC, it will be automatically populating the W-9 information and the amount of paid compensation through Axxess CARE.

If your organization has compensated a clinician outside of the Axxess CARE platform, the amount of additional compensation must also be considered when creating and uploading your organization tax document.

Once approved/uploaded, the document will be available to the clinician in Axxess CARE. Earnings shown for each clinician are estimated based on the transactions completed through Axxess CARE.

Download Clinician Tax Documents

Clinicians can upload tax documentation for your organization to access through Axxess CARE. All clinicians who have completed visits for your organization are listed in Tax Documents section. To download a clinician tax document, click the document image under Clinician Tax Document. If the clinician has not provided a tax document, N/A appears in this column instead.

It is your organization’s sole responsibility to comply with all federal, state and local tax obligations that pertain to all gross compensation provided to an independently contracted clinician. We encourage you to speak with an appropriate professional for assistance in preparing your organization tax document to ensure compliance with any and all applicable federal, state and local laws or ordinances.