Axxess Palliative Care now provides a General Ledger Report that combines multiple financial reports and generates a comprehensive accounting record in an easy-to-use format.

This report helps organizations streamline accounting processes, save time and establish data-driven insights to optimize financial operations.

To view the General Ledger Report, navigate to the Report Center under the Reports tab. In the Billing and Financial Reports section, select General Ledger Report.

Reports tab ➜ Report Center ➜ Billing and Financial Reports ➜ General Ledger Report

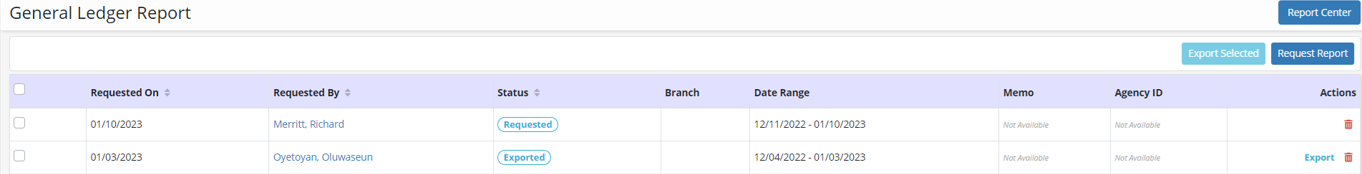

The report screen displays a list of previously generated reports. To delete a report, select the red trash can icon under Actions. To export a report, click Export.

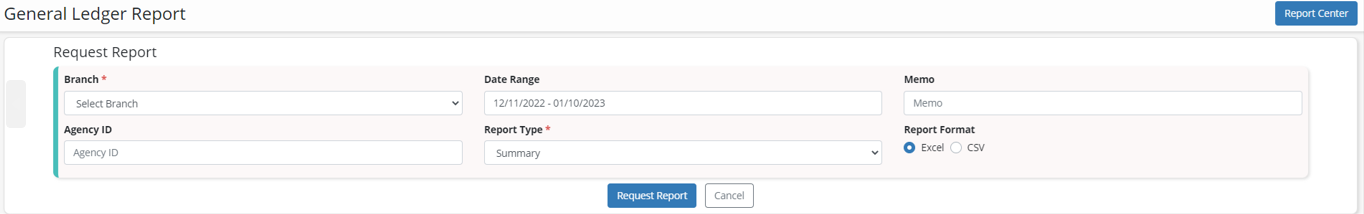

To generate a new General Ledger Report, click Request Report. Complete the required fields and click Request Report again. Refresh your browser to view the report in the list of generated reports. Click Export under Actions to export the report to an Excel file.

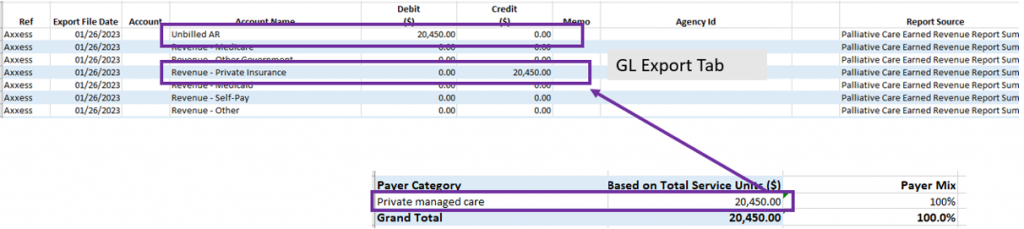

The first section of the report is the Palliative Care Earned Revenue Report Summary section. Revenue accounts are credited by payer type and an offsetting debit is applied to unbilled accounts receivable. This indicates that the revenue has been earned but has not yet been billed. The source for this data is the Summary tab which is associated with the Palliative Care Earned Revenue Report Summary.

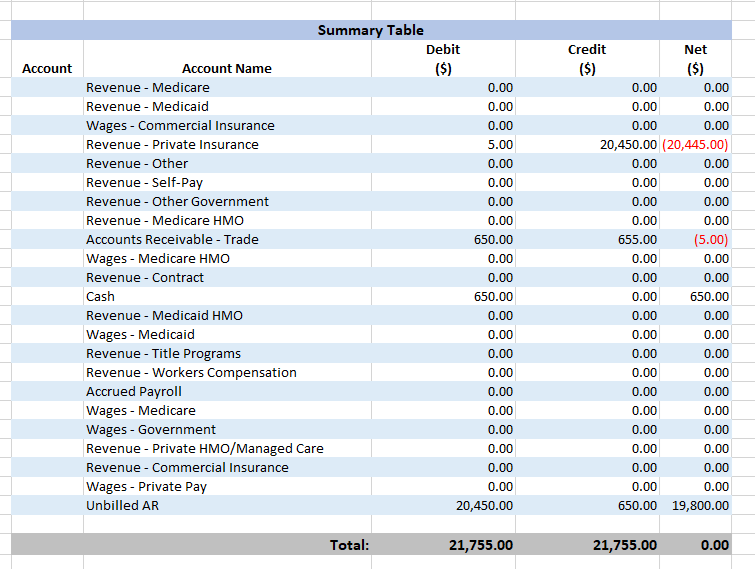

In the example below, $20,450 in revenue from private insurance is equally offset to unbilled accounts receivable.

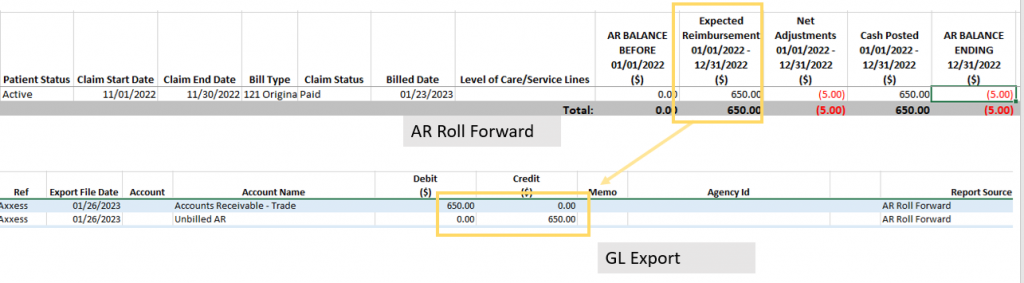

The next section of the report is the AR Roll Forward Report section and describes the accounting effects of the billing process. The total amount billed in the requested period can be seen as a credit to unbilled AR and a debit to accounts receivable trade. This indicates that revenue has been billed, moving it out of one asset account into another.

In the example below, the Expected Reimbursement column of the Month-End AR Roll Forward Report shows $650 in billing for the period. That amount is now debited to accounts receivable trade and credited to unbilled AR, which moves it out of unbilled AR and into accounts receivable trade.

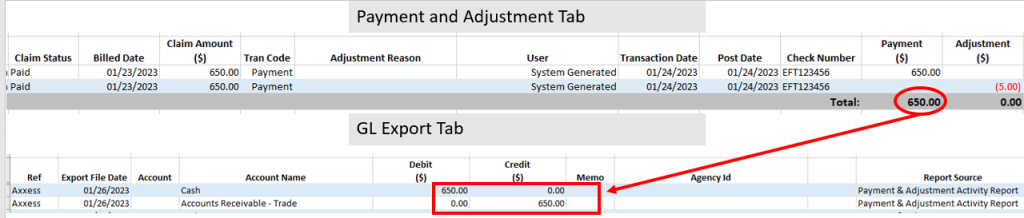

The next section is the Payment and Adjustment Activity Report section and shows the effects of payments received and adjustments posted.

The first portion of this section shows cash receipts. The effect of a cash receipt is to debit cash and credit accounts receivable trade.

In the example below, there is a cash receipt on the Payment and Adjustment Activity Report for $650.

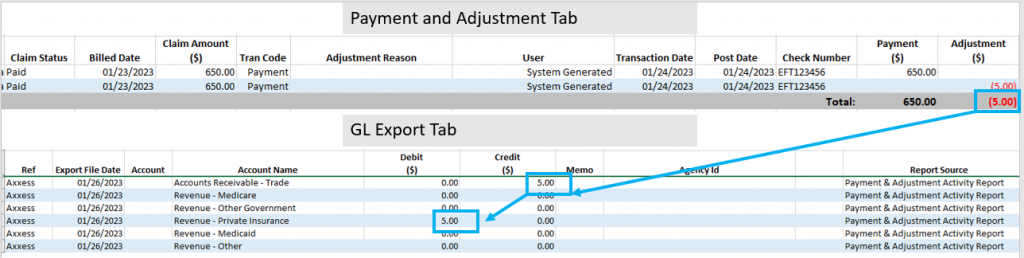

The second portion of this section shows the effects of adjustments. A negative amount in the Adjustment column of the Payment and Adjustment Activity Report indicates less money was received than expected. A positive adjustment indicates more money was received than expected. The example below shows a negative adjustment. This causes a reduction in accounts receivable trade and a debit in revenue.

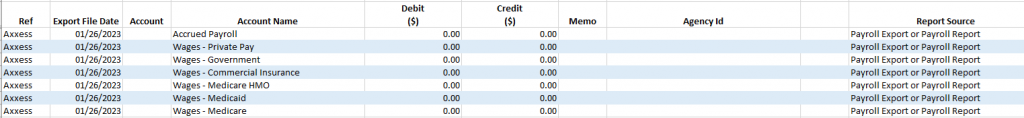

The final section is based on payroll. This section is not yet available, but the accounts are in place for future enhancements. After the final section, you can see the total of all debits and credits along with a variance (if any).

Near the bottom of the page, a summary table displays the total debits and credits for each account.

The Logic Check tab displays a table with the results of comparisons between and within reports. If a discrepancy is identified, the Logic Check column will display Fail next to the failed logic check.

Updated on 01/25/2023